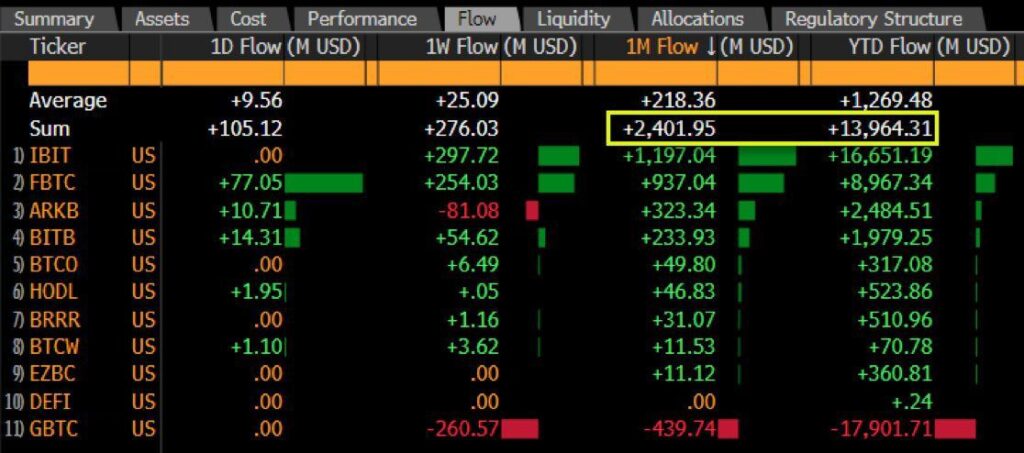

Bitcoin ETFs are gaining momentum, as reports suggest up to $105 million in positive flows on Monday alone. This brings the total cumulative inflows to nearly $2.40 billion over the past three weeks.

Experts ascribe the inflows to increased global liquidity, which can boost the Bitcoin price by improving market sentiment.

Demand for Bitcoin ETFs returns as $105 million flows in on Monday

The market for Bitcoin ETFs continues to gain strength, with $105 million in inflows reported on June 3, marking 15 consecutive days of positive flows and bringing the total to $2.40 billion. Fidelity’s FBTC led the day with $77 million in inflows, while Grayscale’s GBTC and BlackRock’s IBIT saw no net flows. Bitwise’s BITB recorded $14 million, and Ark21Shares’ ARKB saw $10 million in positive flows.

The surge in inflows coincides with a rise in global liquidity. Bitcoin analyst Willy Woo points out that the relationship between BTC price and M2 expansion mirrors broader market sentiment and economic conditions. A high M2 expansion signals loose monetary policy and increased money supply, prompting investors to turn to alternative assets like Bitcoin for potential returns.

Notably, Bitcoin tends to react positively to increases in money supply and inflation concerns, as investors view it as a hedge against traditional fiat currencies such as the US dollar, which may depreciate due to inflation.

BTC Price is in the Accumulation Phase

Bitfinex analysts noted in a Monday market update that Bitcoin ETF inflows for the last two weeks have averaged $136M [million] per day. “This is 4x the $32M daily sell pressure from miners,” they said, observing that Bitcoin is in an accumulation period.

The analysts also highlighted that the correction phase could be nearing its end. They ascribed the recent drop from $73,777 to selling activity among long-term holders. The report indicates that long-term holders have started to re-accumulate BTC for the first time since December 2023.

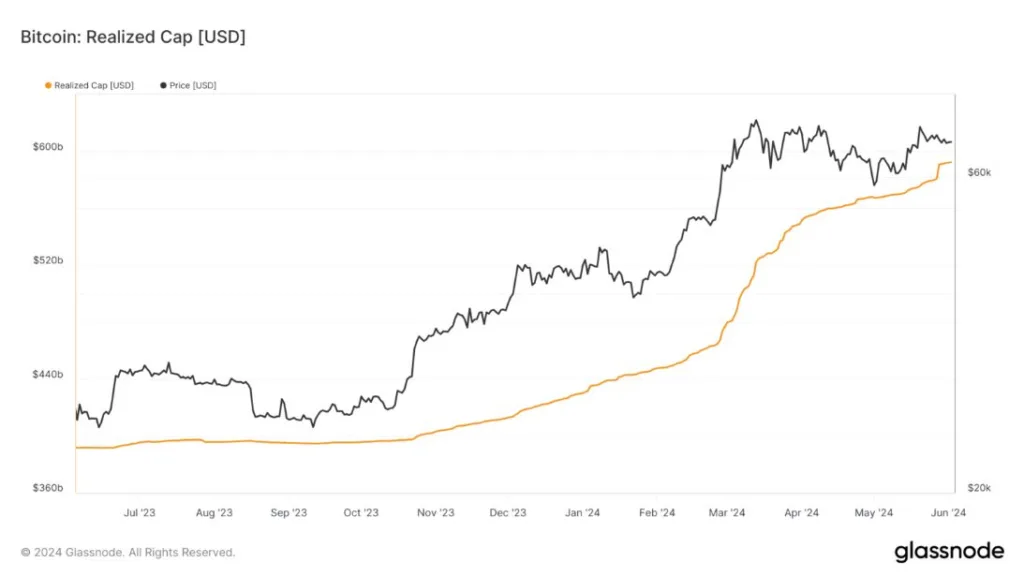

Investor confidence has risen since the April 20 Bitcoin halving, reinforcing the bullish thesis. This can be seen in the surge in Bitcoin’s realized capitalization, approaching $600 billion.

The BTC Realized Cap metric shows Bitcoin’s true value based on the price at which coins last moved. It provides a unique perspective on market dynamics, investor behavior, and historical trends within the Bitcoin ecosystem.

Analyzing Bitcoin Dynamics Amid Changing Investor Sentiment

Since May 1, Bitcoin has consolidated along an ascending trend line, showing higher lows and standing 22% above the range low of $56,552, indicating potential for further gains. Supportive indicators include the Relative Strength Index (RSI) crossing above the signal line and the positive position of the Awesome Oscillator, suggesting bullish sentiment. However, the volume profile indicates mixed activity, necessitating a push above the $72,149 threshold to break free from consolidation. On the downside, a drop below $67,594 could trigger panic selling, potentially leading to a decline to $65,000, with $61,169 presenting a potential buying opportunity if support fails.