Sam Bankman-Fried has been found guilty on all seven counts of fraud, and his first trial has come to a close with FTX’s founder and former CEO facing a possible century in prison.

FTX’s collapse last November triggered a severe crypto winter, with the potential loss of billions in customer funds and heavy regulatory pressure. However, one year later, there’s a real chance that FTX’s estate could return 90% of customer funds. Bitcoin’s price has rebounded, currently sitting above $35,000, as opposed to the low of $15,625 during the darkest days of the crypto winter last year.

Bitcoin’s growth powered by utility potential – and an ETF

Bitcoin swiftly rebounded from the fear of a broader crypto contagion and returned to its pre-collapse levels.

On January 18, it was reported that Bitcoin had completely recovered from its decline related to FTX.

While macroeconomics certainly contributed to Bitcoin’s rapid recovery, the expanding range of utility applications built around the Bitcoin blockchain also played a crucial role.

Jason Fang, the managing partner at Sora Ventures, emphasized in an interviewthat Bitcoin’s price, whether it reaches $200k or $400k, would be driven not solely by speculation but by the perceived value of its utility.

“They’re centralized in tech and funding. If one fails, they’re in trouble. Bitcoin, however, is funded by miners, who are incentivized by the utility to support the network,” he reported

“This leads to a more profitable business for them. Bitcoin’s path is unique and not dependent on being Ethereum-compatible, which gives it a stronger narrative.”

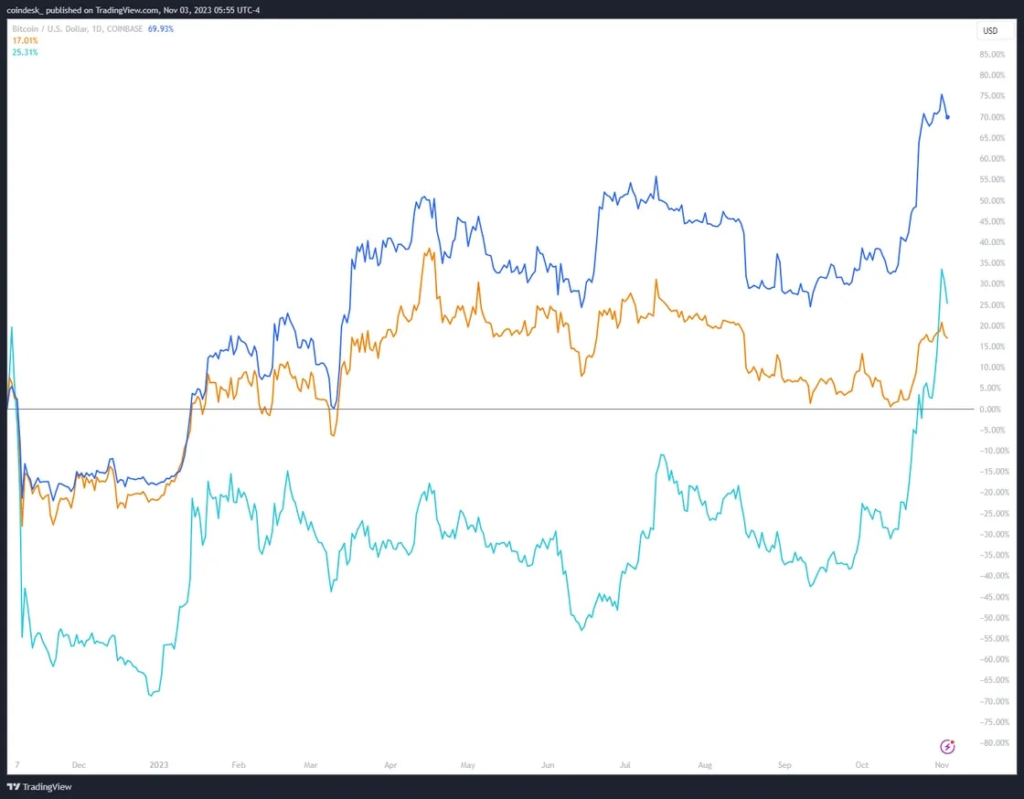

But it’s not like ether or sol have been slouches in their performance over the last year.

Ether is up 17% on-year, while sol is up 26%. But bitcoin is up 70%. That’s because as Metalpha’s Lucy Hu explains, the market is anticipating an ETF and movement from the Fed.

She mentioned that Bitcoin’s price in the short and medium term would continue to be influenced by factors such as ETF approvals, potential Fed rate cuts, bullish sentiment from institutional investors like Microstrategy, and the upcoming halving event in the first half of next year.

The consensus wisdom currently is that spot bitcoin ETFs are likely to be approved as early as January 2024, with a raft of big names, including BlackRock and Fidelity, readying offerings.

Trading Volumes Ending the Year Strong

Despite the prolonged wait for ETF approval, renewed institutional interest has piqued traders’ attention.

Crypto trading volume remained sluggish for most of the year, impacting publicly-listed Coinbase’s earnings.

In September, crypto spot market activity hit a 4.5-year low.

However, a shift occurred in late October with increased focus on ETFs and a thawing market, leading to a surge in trading volumes. By month-end, crypto investment funds attracted their largest inflow in 15 months, totaling $326 million.

Jason Fang noted, “Bitcoin has demonstrated its resilience, especially following the FTX implosion, proving it’s not a mere scam chain and is here to stay.”