NFT sales volumes reached 68,342 ETH in the week ending Nov. 6, as reported by blockchain analytics firm Nansen. According to Nansen’s insights, there has been a consistent upward trend in weekly Ether sales volume for nonfungible tokens (NFTs). Specifically, on the week ending Oct. 9, NFT sales stood at 29,704 ETH, equivalent to approximately $56 million based on current ETH market prices. This weekly sales volume progressively grew, ultimately reaching 68,342 ETH, representing a value exceeding $129 million.

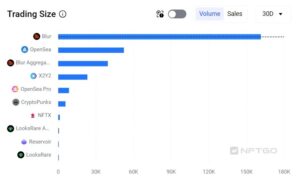

In terms of NFT trading volume distribution over the last 30 days, the NFT marketplace Blur claimed the top position. Data aggregator NFTGo reported that Blur achieved a trading volume of 161,433 ETH, equivalent to about $305 million during this period. Following closely in second place was the competitor OpenSea, which recorded a trading volume of 52,307 ETH, worth approximately $100 million.

In the realm of NFT collections, Bored Ape Yacht Club (BAYC) led the pack in trading volume over the last 30 days, amassing a volume of 35,226 ETH, valued at $66.7 million. Following closely, the Mutant Ape Yacht Club (MAYC) secured the second spot with 14,947 ETH in volume, and The Captainz followed with 9,948 ETH.

Despite CryptoPunks maintaining its position as the top collection in terms of market capitalization, its trading volume in the last 30 days amounted to only 5,773 ETH.

In addition, NFTGo’s data revealed a noteworthy development in the NFT market, with a 12% increase in the number of NFT traders in the past seven days. There were 22,804 buyer addresses and 27,308 seller addresses during this period. Meanwhile, the number of wallets holding NFTs remained steady at around 6 million.

The increase in trading volume for NFTs happened amid seemingly bearish news for the NFT market. On Nov. 3, NFT marketplace OpenSea laid off half of its staff as it prepared to launch its second version.